45 what is bond coupon rate

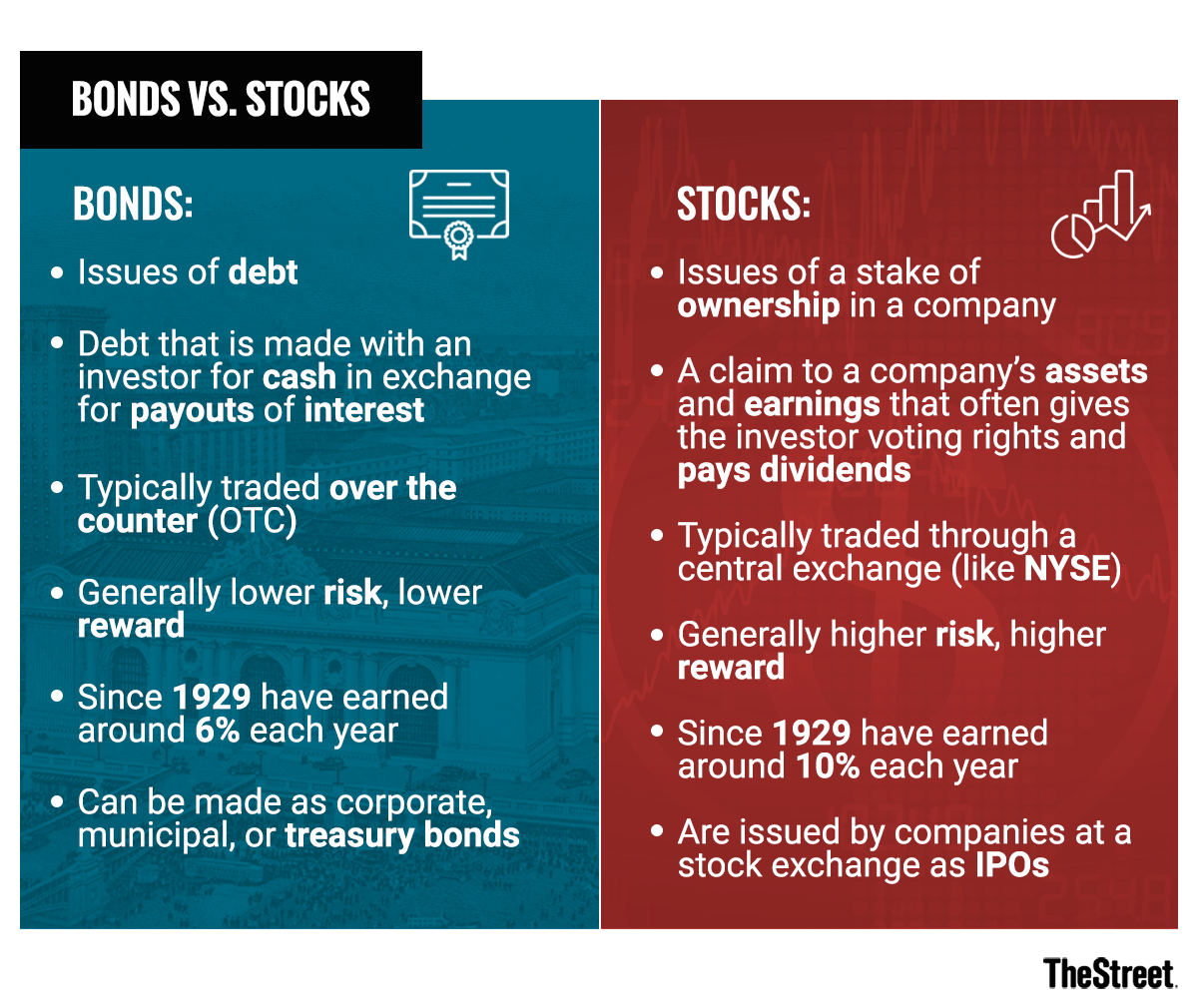

Bond Yield Rate vs. Coupon Rate: What's the Difference? The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

What is bond coupon rate

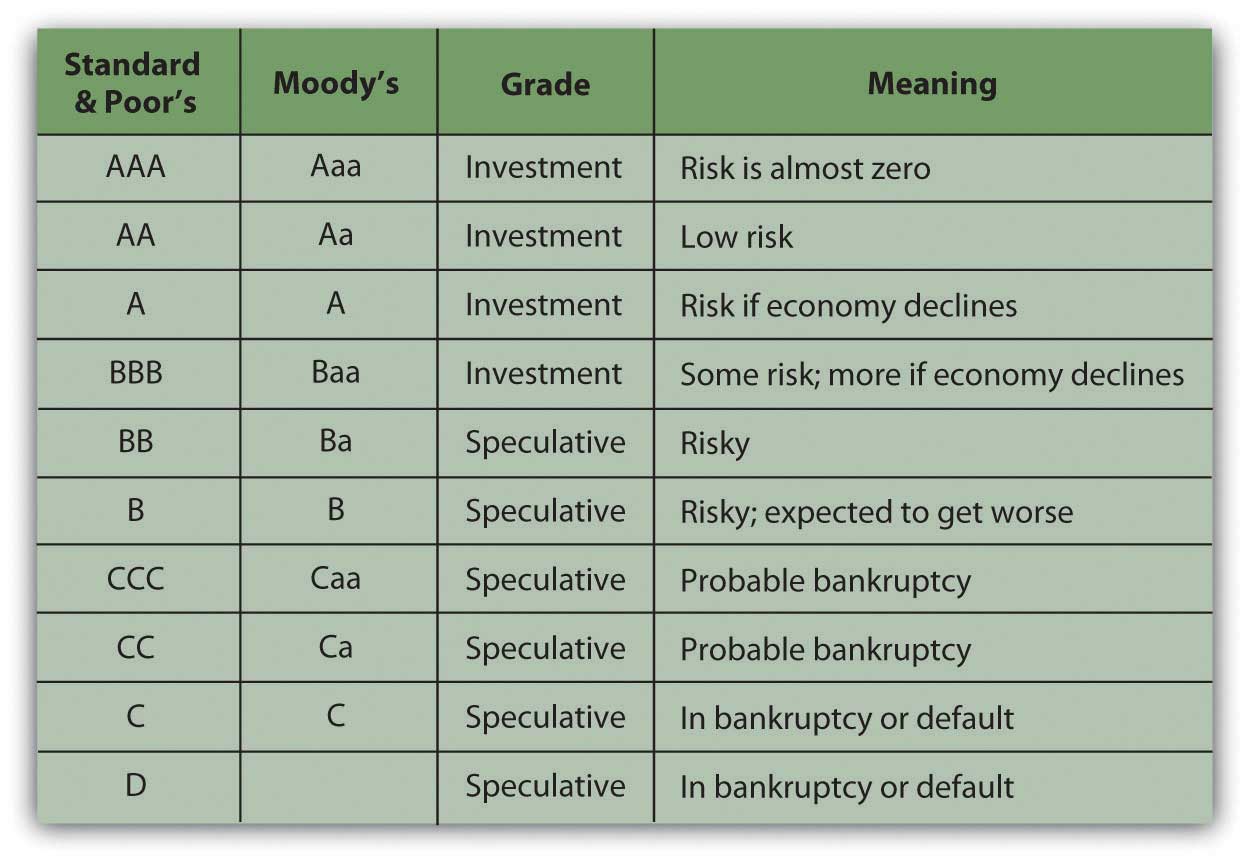

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. › terms › cWhat Is a Coupon Bond? - investopedia.com Mar 31, 2020 · A coupon bond is a debt obligation with coupons attached that represent semiannual interest payments, also known as a "bearer bond." ... the coupon bond simply refers to the rate it projects ...

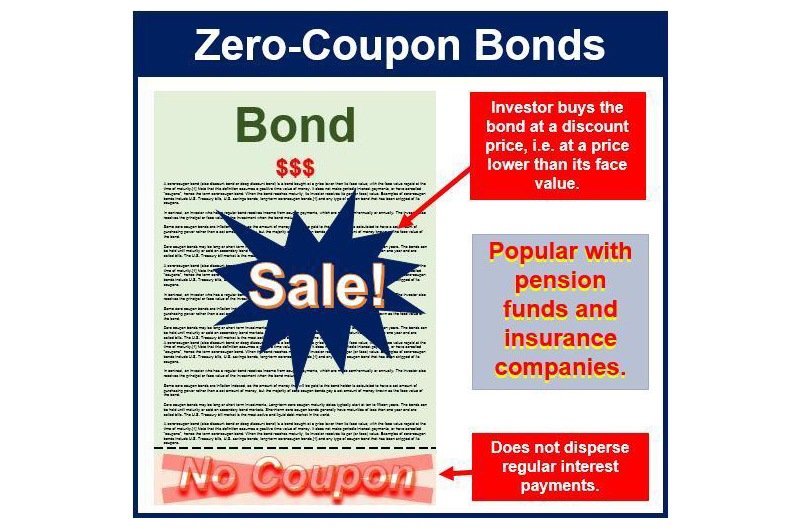

What is bond coupon rate. What Are Coupon and Current Bond Yield All About? - dummies A $1,000 bond with a coupon yield of 5 percent is going to pay $50 a year. A $1,000 bond with a coupon yield of 7 percent is going to pay $70 a year. Usually, the $50 or $70 or whatever will be paid out twice a year on an individual bond. Bond funds don't really have coupon yields, although they have an average coupon yield for all the bonds ... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. What is a Coupon Rate? | Bond Investing | Investment U Coupon rates are the static variable in a dynamic bond market. This makes them an important variable in establishing market rates. The Inverse Relationship Between Price and Yield As bond prices fluctuate and coupon rates stay the same, the yield of a bond changes. This is an extremely important consideration because it changes the value of a bond. corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

› gold-rate › sovereign-goldSovereign Gold Bond - Schemes, Price, Returns, Interest Rate 2020 Apr 28, 2021 · The tenor of the SGBs is 8 years. However, one can also encash/ redeem the bond after 5th year from the date of issue on coupon payment dates. On maturity: The investor will be advised one month before maturity. On maturity, the gold bonds will be redeemed in Indian rupees based on the selling price published by the Indian Bullion and Jewelers ... Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate , which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. What Is a Coupon Rate? How To Calculate Them & What They're Used For A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. › terms › cCoupon Rate Definition Sep 05, 2021 · The coupon rate is the interest rate paid on a bond by its issuer for the term of the security. The term "coupon" is derived from the historical use of actual coupons for periodic interest payment ... Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. Is coupon rate same as interest rate? Definition of 'Coupon Rate' Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. The bond issuer pays the interest annually until maturity, and after that returns the principal amount (or face value) also.Coupon rate is not the same as the rate of interest.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

What Is a Coupon Rate? And How Does It Affects the Price of a Bond? Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond? Every type of bonds does pay interest to bondholder. Such amount of interest is called coupon rate of interest. The coupon rate is fixed over time.

Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders.

Bond Prices, Rates, and Yields - Fidelity Coupon rate—The higher a bond's coupon rate, or interest payment, the higher its yield. That's because each year the bond will pay a higher percentage of its face value as interest. Price—The higher a bond's price, the lower its yield. That's because an investor buying the bond has to pay more for the same return.

What is Coupon Equivalent Rate? | IIFL Knowledge Center The coupon equivalent rate is a calculation of the effective yield on a zero-coupon bond. The effective yield is the annual rate of return attached with a period of interest rate, while a zero ...

Which Bonds Will Have The Higher Coupon - WhatisAny Would a secured or unsecured bond have a higher coupon rate Why? Because secured bonds are considered safer than unsecured bonds, secured bonds normally have lower coupon rates. More reward may be in the form of a higher coupon rate or a lower purchase price. Either one — or both — lead to a higher yield for the investor.

2022 Corporate Bond Outlook: Focus on Income | Charles Schwab Preferred securities should be considered for income-oriented investors. Like the rest of the bond market, preferred securities' yields are low, and prices are high. However, there are few options that can offer such high coupon payments. The average coupon rate of the ICE BofA Fixed Rate Preferred Securities Index is 5.1%.

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Post a Comment for "45 what is bond coupon rate"