41 advantage of zero coupon bonds

Zero Coupon Bonds- Taxability under Income Tax Act, 1961 The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - ... Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. These are subject to capital gains tax only. The best advantage of a zero-coupon bond to the issuer is that the ... The best advantage of a zero-coupon bond to the issuer is that the. Bond requires a low issuance cost. Bond requires no interest income calculation to the holder or issuer until maturity. Interest can be amortized annually by the APR method and need not be shown as an interest expense to the issuer.

Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

Advantage of zero coupon bonds

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Apr 28, 2022 · In the US, Government dealer firms usually break down a coupon-bearing bond into a series of zero-coupon bonds by considering each cash flow as a separate bond. For example, a 5-year semiannual coupon-bearing bond can be split into 10 zero-coupon bonds with coupon amount as face value and 1 zero-coupon bond with the principal amount as the face ... Zero-Coupon Bonds - Tax Professionals Member Article By Carmen Garcia A zero-coupon bond is a type of bond that earns no interest during its lifetime. A zero-coupon bond is issued with a sudden reduction in par value or face value, which is the amount that will be paid for the bond at maturity. An investor receives a one-time interest payment at maturity equal to the difference between the face value and the ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them...

Advantage of zero coupon bonds. The best advantage of a zero-coupon bond to the ... - Accounting MCQs The best advantage of a zero-coupon bond to the issuer is that the Accounting MCQs | Accounting MCQs MCQs Papers Definitions Flashcards Categories Insurance License Texas Life and Health Absorption Costing ACAMS Practice Questions Accounting Basics Accounting Cycle and Classifying Accounts Accounting For Managers Zero Coupon Bonds India- Invest in Zero Coupon Bonds Advantages of Zero Coupon Bonds Investors often compare zero coupon bonds with other fixed income options so as to check in for minimal risks. The returns on zero coupon bonds are good enough at maturity and the option always remain to sell them in the secondary market, if the interest rates decline intensely. › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Instead, it is sold at a considerable discount to its par value. For example, a $1000 bond might be traded on the open market at a cost of $600, to be paid in full after 10 years. Quite often, standard issue bonds will be stripped of their coupons and sold on the public market as zero coupon bonds. quizlet.com › 463327183 › finance-chapter-6-flash-cardsFinance Chapter 6 Flashcards - Quizlet A) The yield to maturity of a coupon bond is a weighted average of the yields on the zero-coupon bonds. B) If the zero-coupon yield curve is downward sloping, the yield to maturity will decrease with the coupon rate. C) The information in the zero-coupon yield curve is sufficient to price all other risk-free bonds.

Zero-Coupon Bonds: Pros and Cons Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more. The Pros and Cons of Zero-Coupon Bonds - Financial Web Pros One of the big advantages of zero coupon bonds is that they have higher interest rates than other corporate bonds. In order to attract investors to this type of long-term proposition, companies have to be willing to pay higher interest rates. What are the advantages and disadvantages of zero-coupon bond? Originally Answered: What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival. Pros and Cons of Zero-Coupon Bonds | Kiplinger Their big advantage is that you know how much you'll collect a certain number of years from now. In mid June, for example, you could have bought a U.S. Treasury zero for $341 that matures in August...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child's education, marriage, post-retirement goals, etc. Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... Advantage of Zero-Coupon Bonds From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Advantages and Disadvantages of Bonds | Boundless Finance | | Course Hero Zero coupon bonds: A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. ... Advantages of Bonds Bonds have a clear advantage over other securities. The volatility of bonds (especially short and medium dated bonds) is ...

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

› terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

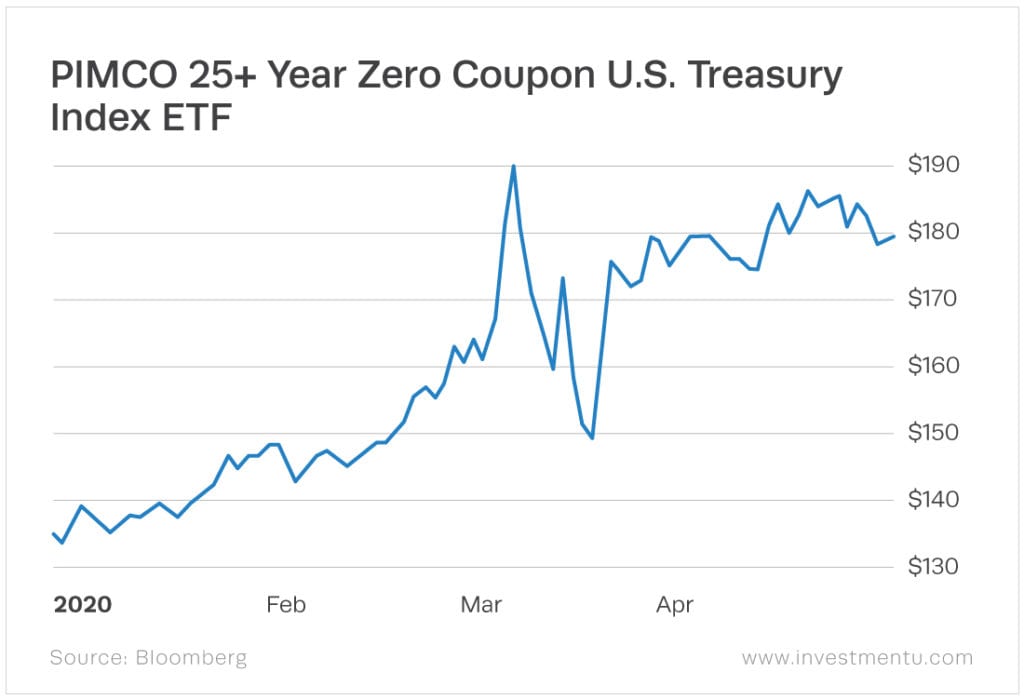

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

› article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity.

A zero-coupon bond is a discounted investment that can help you save ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them more attractive to investors. As a result, these bonds often come with higher yields than traditional bonds.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

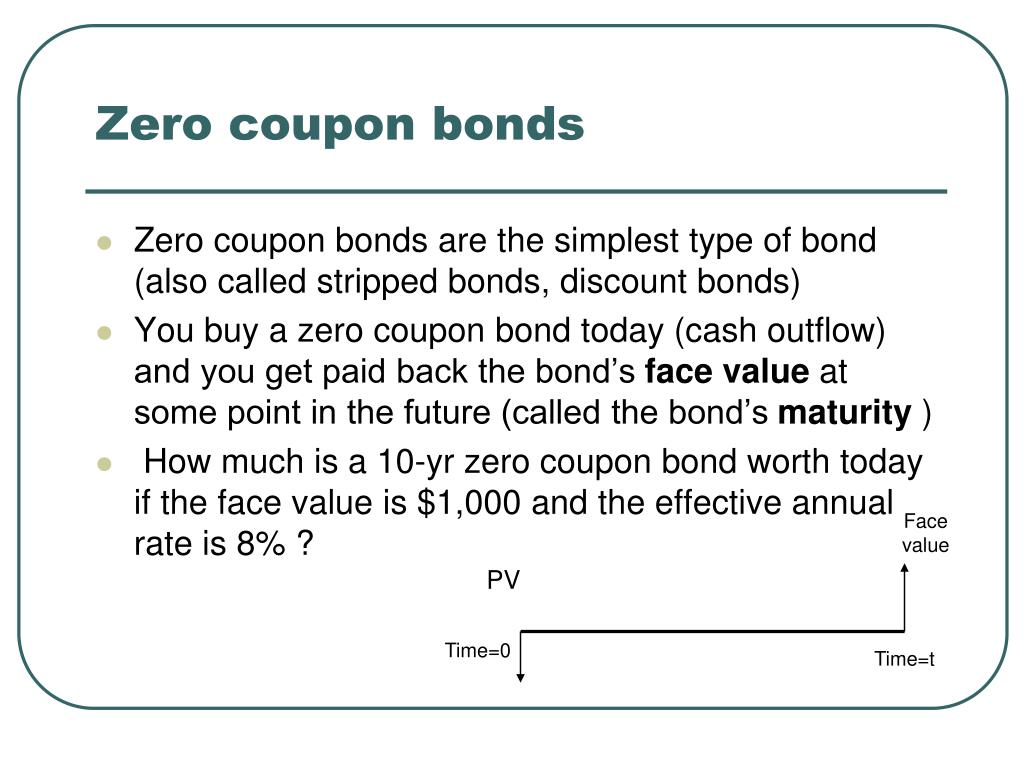

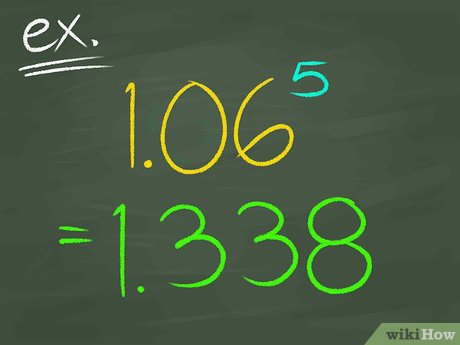

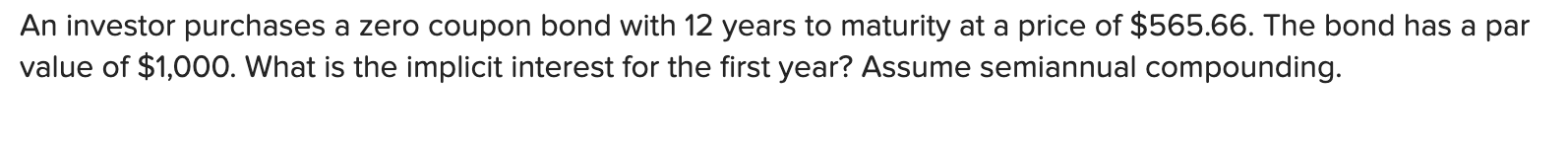

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Since the Interest accrued is discounted from the Par value of such Bonds at purchase, which effectively enables Investors of Zero Coupon Bonds to buy a greater number of such bonds compared to any other Coupon Bearing Bond. Zero-Coupon Bond Formula we can calculate the Present value of using this below-mentioned formula:

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

What Is a Zero Coupon Bond? | The Motley Fool Over the 10 years, and you will collect a total of $30 in interest, plus, at the end of the term, the company pays you back your initial $100 investment. In contrast, with a zero coupon bond with ...

Zero coupon bonds what are the advantages and - Course Hero ANSWER: From the perspective of the issuing firm, low or zero coupon bonds have the advantage of requiring low or no cash outflow during the life of the bond. The issuing firm is allowed to deduct the amortized discount as interest expense for federal income tax purposes, which adds to the firm's cash flow.

Zero-Coupon Bond - an overview | ScienceDirect Topics Zeros are also preferred during a period of relatively high interest rates, as the compounding effect is greater. As a zero-coupon bond is issued at a discount to its face value, and then repaid at par, there is a significant liability for the borrower on maturity. For a long-dated bond this liability can be very large.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

› fixed-income-bonds › individualCorporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable

Post a Comment for "41 advantage of zero coupon bonds"