45 calculate coupon rate in excel

Coupon Rate Template - Free Excel Template Download C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Excel Modeling Templates PowerPoint Presentation Templates Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio

Calculate coupon rate in excel

› documents › excelHow to calculate bond price in Excel? - ExtendOffice Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can ... Bonds Calculate Coupon Rate - YouTube how to calculate coupon rate on a bondexamples using excel and financial calculator › ask › answersCalculate a Forward Rate in Excel - Investopedia Jun 25, 2019 · You need to have the zero-coupon yield curve information to calculate forward rates, even in Microsoft Excel. ... interest rate for the first year and the interest rate for the second year. Thus ...

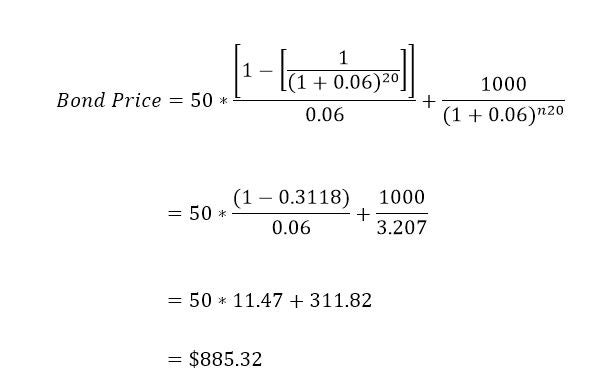

Calculate coupon rate in excel. How to calculate YTM in Excel | Basic Excel Tutorial 1. Launch the Microsoft Excel program on your computer. 2. Write the following words from cells A2 -A5. Future Value, Annual Coupon rate, Years to maturity, and Bond Price 3. Format the column width in the excel sheet so that it is wide enough to accommodate all characters. 4. Let us enter the corresponding values of our example in Column B. Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. 10.5 Using Spreadsheets to Solve Bond Problems Calculating the Yield to Maturity (Interest Rate) of a Bond. Use the following steps in Excel to determine the YTM (interest rate) of a bond. Assume that you want to find the YTM of a $1,000, 3.5% bond with annual coupon payments that is selling for $675.00 and will mature in 12 years. First, select Formulas from the Excel upper menu bar, and ... Coupon Bond Formula | Examples with Excel Template Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments... How to Calculate Discount in Excel: Examples and Formulas In detail, the steps to write the calculation process of the discounted price in excel are as follows: Type the equal sign ( = ) in the cell where you want to place the discounted value ; Input the original price or the cell coordinate where the number is after =. Then, type in a minus sign ( - ); Input the discount percentage or the cell coordinate where the percentage is. What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1

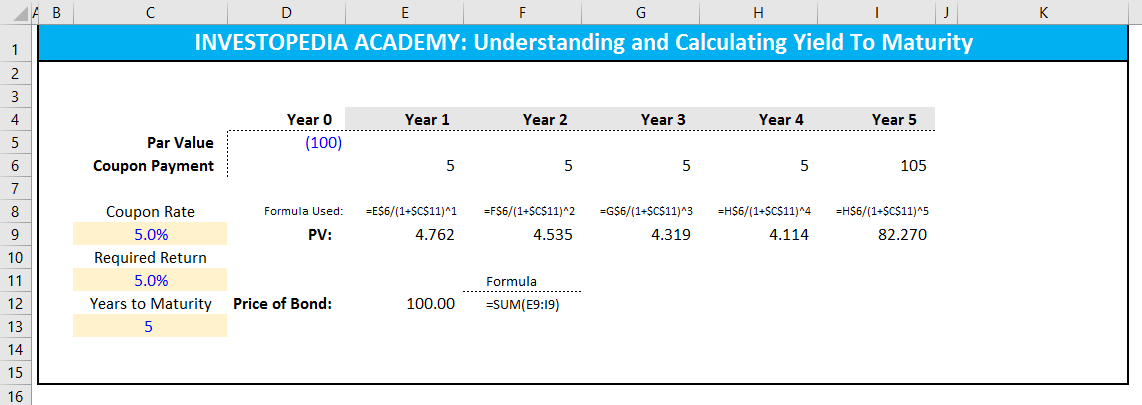

How to Calculate Bond Yield in Excel: 7 Steps (with Pictures) Skipping cell A9, type "Value of Bond" in cell A10. Skip cell A11, and type "Bond Yield Calculations" in cell A12, "Current Yield" in cell A13, "Yield to Maturity" in cell A14 and "Yield to Call" in cell A15. 2. Format the column width. Move the mouse pointer over the line separating columns A and B, just above the Bond Yield Data column heading. 3 Ways to Calculate Bond Value in Excel - wikiHow 1. Type the column heading and data labels. Beginning with cell A1, type the following text into cells A1 through A8: Bond Yield Data, Face Value, Annual Coupon Rate, Annual Required Return, Years to Maturity, Years to Call, Call Premium and Payment Frequency. Skipping over cell A9, type "Value of Bond" in cell A10. 2. Using RATE function in Excel to calculate interest rate - Ablebits The RATE function in Excel can also be used for calculating the compound annual growth rate (CAGR) on an investment over a given period of time. Supposing you want to invest $100,000 for 5 years and receive $200,000 in the end. How will your investment grow in terms of CAGR? How to calculate Spot Rates, Forward Rates & YTM in EXCEL The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond ).

Yield of a Coupon Bond calculation using Excel. How to calculate Yield ... Yield of a Coupon Bond calculation using Excel. How to calculate Yield of a Coupon Bond? byAdmin May 25, 2021. ... So you just use this formula right here use this Rate formula in Excel and that will tell you that the yield to maturity on this bond is 5.84%.

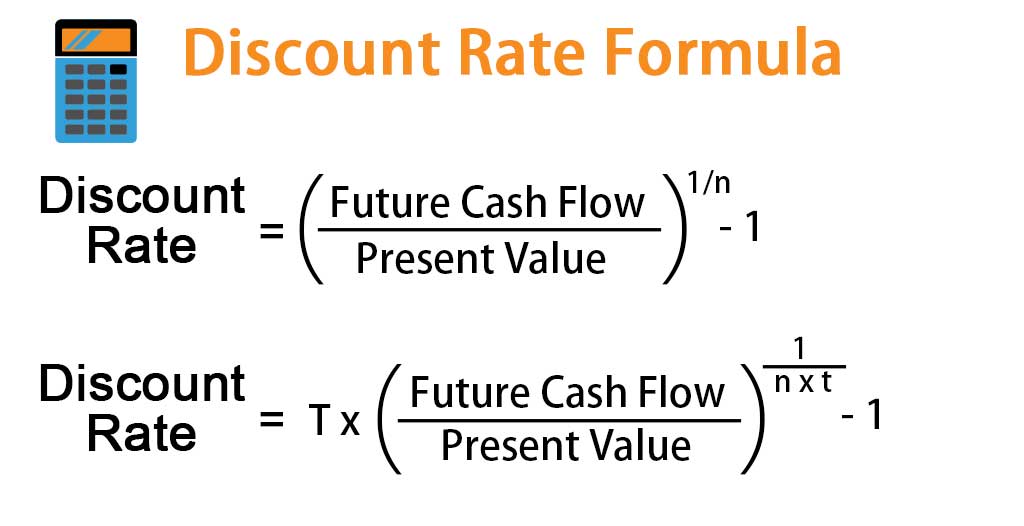

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

› ask › answersExcel Discount Rate Formula: Calculation and Examples Discount Rate First, let's examine each step of NPV in order. The formula is: NPV = ∑ {After-Tax Cash Flow / (1+r)^t} - Initial Investment Broken down, each period's after-tax cash flow at time t...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

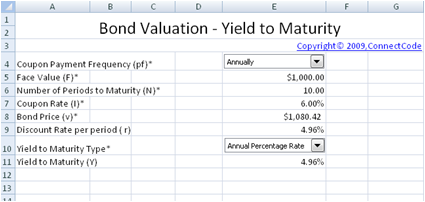

Microsoft Excel Bond Yield Calculations | TVMCalcs.com This can be tedious to do by hand. Fortunately, the Rate() function in Excel can do the calculation quite easily. Technically, you could also use the IRR() function, but there is no need to do that when the Rate() function is easier and will give the same answer. To calculate the YTM (in B14), enter the following formula: =RATE(B5*B8,B3/B8*B2 ...

Bootstrapping | How to Construct a Zero Coupon Yield Curve in Excel? Calculation of zero-coupon discount rate for 2 year - Zero-coupon rate for 2 year = 3.5% + (5% - 3.5%)* (2- 1)/ (3 - 1) = 3.5% + 0.75% Zero-Coupon Rate for 2 Years = 4.25% Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25% Conclusion

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%.

› Calculate-Compound-InterestHow to Calculate Compound Interest: 15 Steps (with Pictures) Feb 04, 2022 · Calculate interest compounding annually for year one. Assume that you own a $1,000, 6% savings bond issued by the US Treasury. Treasury savings bonds pay out interest each year based on their interest rate and current value. Interest paid in year 1 would be $60 ($1,000 multiplied by 6% = $60).

Post a Comment for "45 calculate coupon rate in excel"