45 difference between yield to maturity and coupon rate

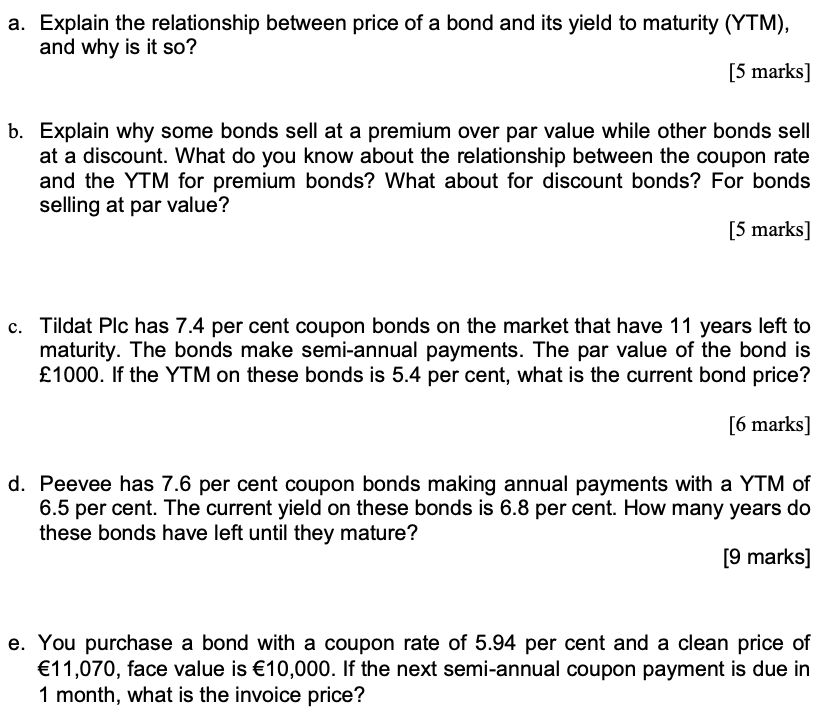

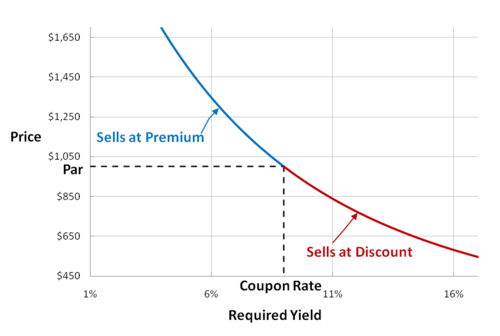

Learn How Coupon Rate Affects Bond Pricing › coupon-rate-vs-interest-rateCoupon Rate vs Interest Rate | Top 8 Best Differences (with ... Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

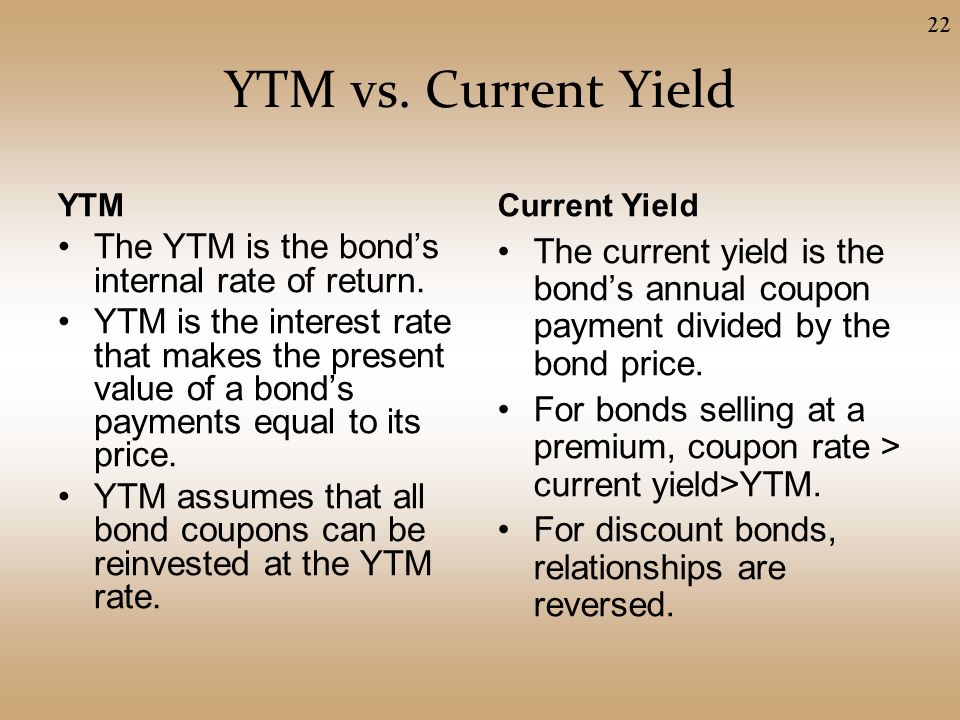

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Difference between yield to maturity and coupon rate

› ask › answersYield to Maturity vs. Holding Period Return: What's the ... Oct 07, 2022 · Some examples are yield to call, yield to worst, current yield, running yield, nominal yield (coupon rate), and yield to maturity (YTM). Most investors are concerned with the yield to maturity ... › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia Perpetual: no maturity Period. Coupon. The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR).

Difference between yield to maturity and coupon rate. › terms › mMaturity Definition - Investopedia Apr 18, 2022 · Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed or it will cease to exist. The term is commonly used for deposits ... › ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia Perpetual: no maturity Period. Coupon. The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR). › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

› ask › answersYield to Maturity vs. Holding Period Return: What's the ... Oct 07, 2022 · Some examples are yield to call, yield to worst, current yield, running yield, nominal yield (coupon rate), and yield to maturity (YTM). Most investors are concerned with the yield to maturity ...

:max_bytes(150000):strip_icc()/female-executive-talking-to-colleagues-117455512-5750d4d75f9b5892e8b3d3af.jpg)

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "45 difference between yield to maturity and coupon rate"