41 coupon vs interest rate

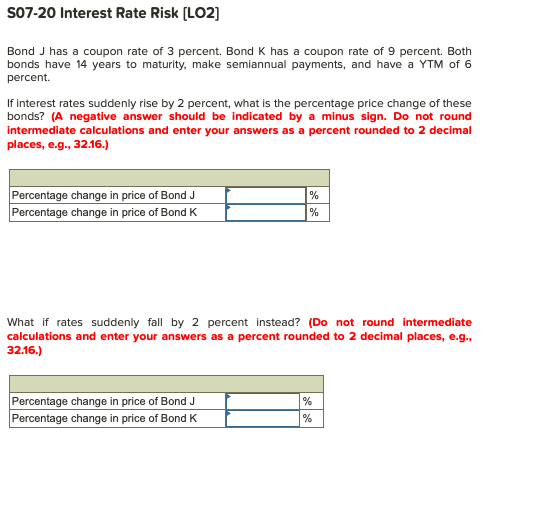

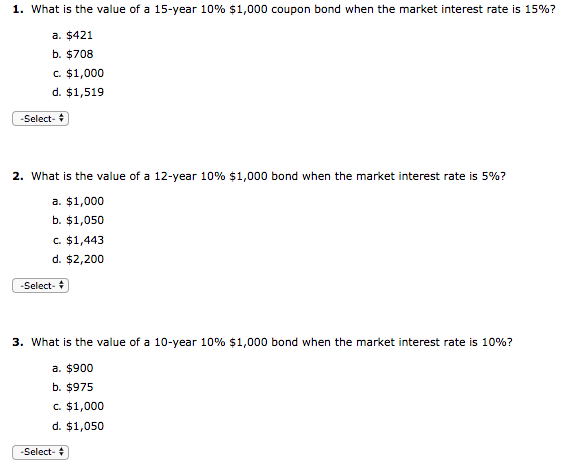

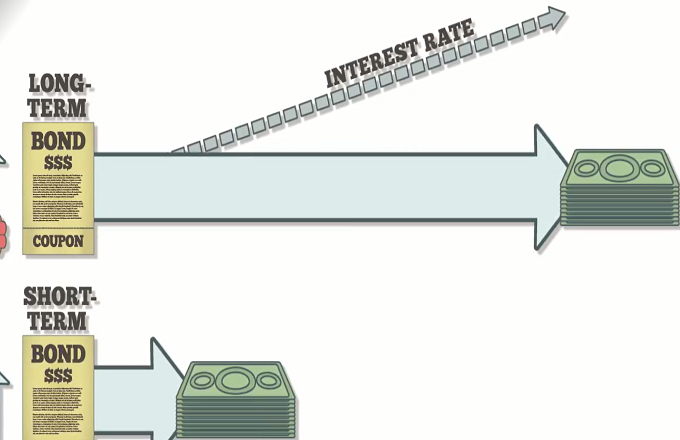

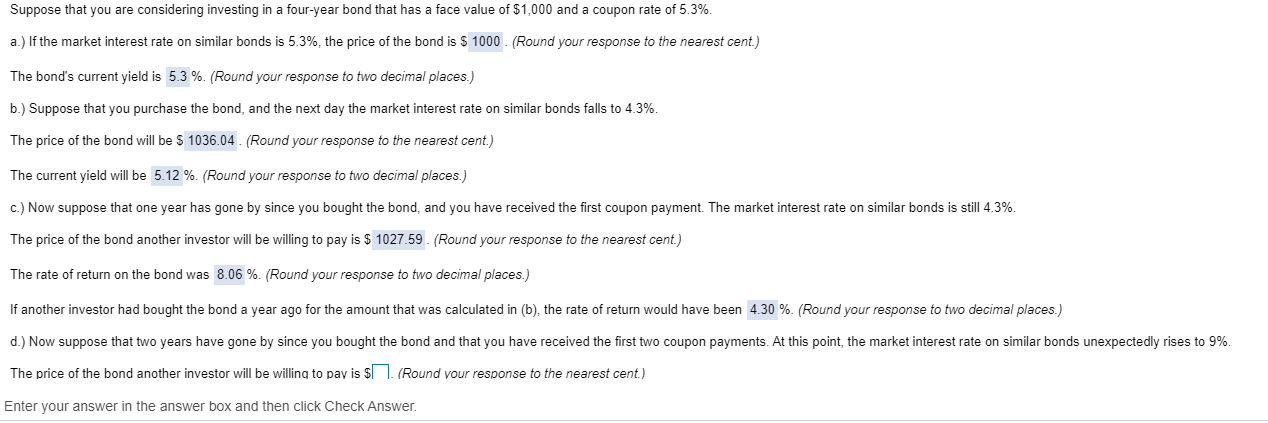

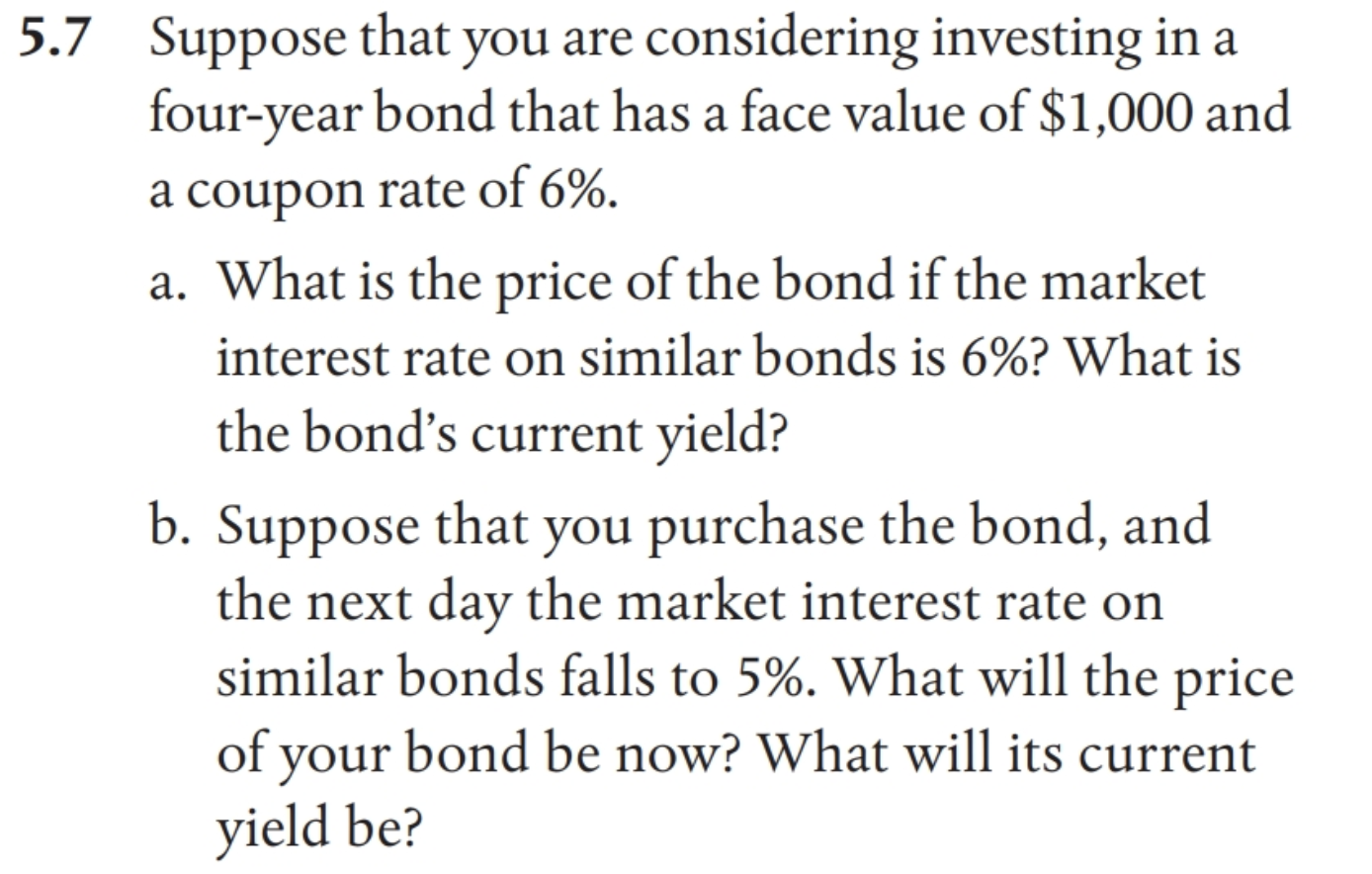

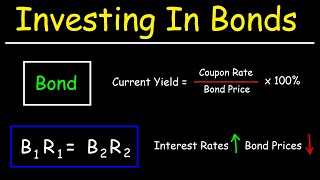

What is difference between coupon rate and interest rate? The interest payment is fixed, it never changes. What changes (daily, usually) is the price of the bond after it's issued. The "coupon" is the annual interest rate the borrower (i.e., the bond issuer) is obliged to pay every year on a $1000 loan (i.e. bond), until maturity. At maturity, the issuer pays back the $1000. Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. ... A single discount rate applies to all as-yet-unearned interest payments ...

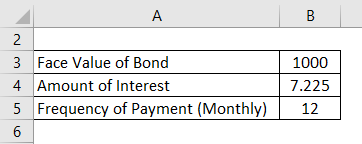

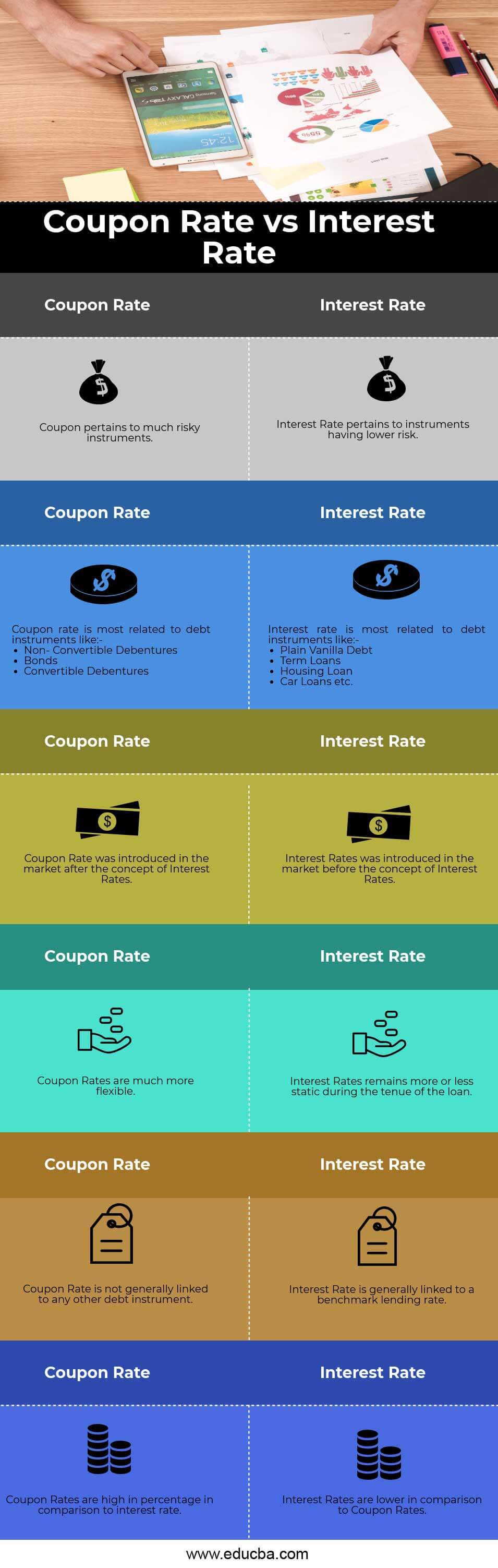

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds.

Coupon vs interest rate

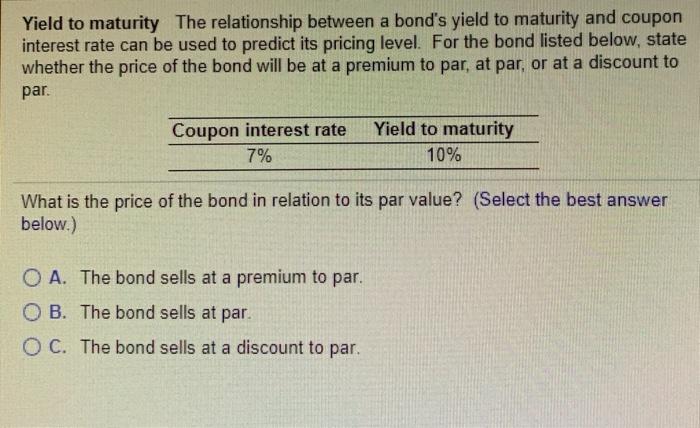

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. ... Yield to Maturity vs. Coupon Rate ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ... PPF: Does It Still Offer More Interest Rate Than Bank FD? Check Details PPF Vs Bank FD. The PPF is offering 7.1 per cent fixed interest rate and comes with the EEE tax exemption rule. On the other hand, HDFC Bank is now offering FD interest rates up to 6.25 per cent to the general public on a deposit tenure of 2 years 1 day to 3 years. PNB is offering up to 7 per cent to the general public on the 600-day tenure ...

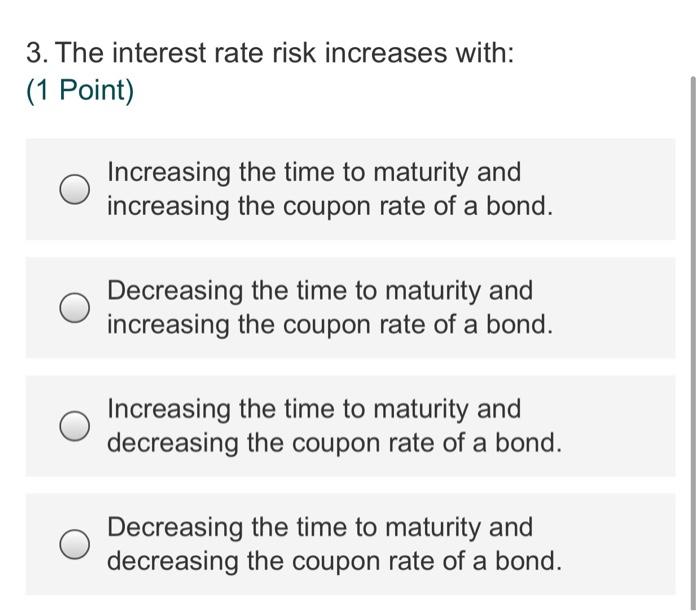

Coupon vs interest rate. CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in mid ... Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The yield of a bond changes with a change in the interest rate in the economy, but the coupon rate does not have the effect of the interest rate. Recommended Articles. This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table. Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Coupon Rate vs. Interest Rate - Key Differences. The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond Value Of The Bond Bonds refer to the debt instruments issued by governments or corporations to acquire investors' funds for a certain period. read more, which is being invested. Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Coupon Rate Definition The coupon rate is the interest rate paid on a bond by its issuer for the term of the security. The term "coupon" is derived from the historical use of actual coupons for periodic interest payment ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Discover the difference between coupon rate vs. interest rate and identify how to calculate coupon rate using the coupon rate formula. Updated: 04/08/2022 Table of Contents

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA Key differences between Coupon Rate vs Interest Rate. Let us discuss some of the major differences between Coupon Rate vs Interest Rate : The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business ... Difference Between Coupon Rate and Interest Rate Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender. Summary: Coupon Rate vs Interest Rate. Coupon rate of a fixed term security such as bond is the amount of yield paid annually that expresses as a percentage of the par value of ... Difference Between Coupon Rate and Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. Also, it depends on the par value, that is, the face ... Coupon Rate vs. Interest Rate - What's The Difference (With Table) A coupon rate is defined as the nominal yield paid by fixed-income security. Interest rate is defined as the amount a lender charges a borrower and is a percentage of the principal amount. Fixed/flexible. Coupon rates are generally more flexible and change from time to time.

Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver. In contrast, Yield to Maturity (YTM ...

PPF: Does It Still Offer More Interest Rate Than Bank FD? Check Details PPF Vs Bank FD. The PPF is offering 7.1 per cent fixed interest rate and comes with the EEE tax exemption rule. On the other hand, HDFC Bank is now offering FD interest rates up to 6.25 per cent to the general public on a deposit tenure of 2 years 1 day to 3 years. PNB is offering up to 7 per cent to the general public on the 600-day tenure ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ...

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. ... Yield to Maturity vs. Coupon Rate ...

Post a Comment for "41 coupon vs interest rate"