42 present value of a zero coupon bond

PDF Econ 340, Fall 2011 Problem Set 2 Chapter 3: Questions 1-2 ... 1. Calculate the present value of $1,000 zero-coupon bond with 5 years to maturity if the yield to maturity is 6%. Solution: PV = FV/(1 + i)n, where FV = 1000, i = 0.06, n = 5 PV = 747.25 See Durationexamp.xls 3. Consider a bond with a 7% annual coupon and a face value of $1,000. Complete the Bond vs Loan | Top 7 Best Differences (with Infographics) Government bond yields Bond Yields The bond yield formula evaluates the returns from investment in a given bond. It is calculated as the percentage of the annual coupon payment to the bond price. The annual coupon payment is depicted by multiplying the bond's face value with the coupon rate. read more are likely to be low and are a safer ...

Solved 1. Calculate the present value of a $1000 zero ... Question: 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity. What is the bond's yield to maturity? This problem has been solved!

Present value of a zero coupon bond

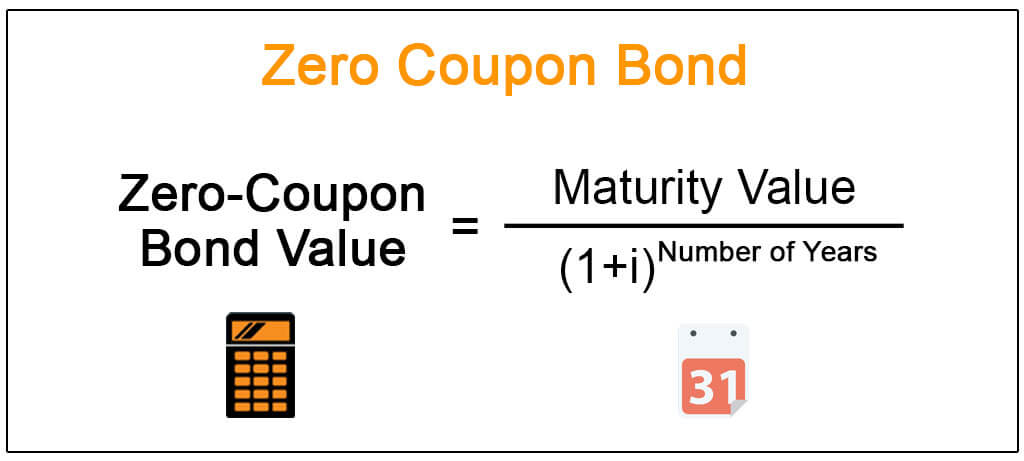

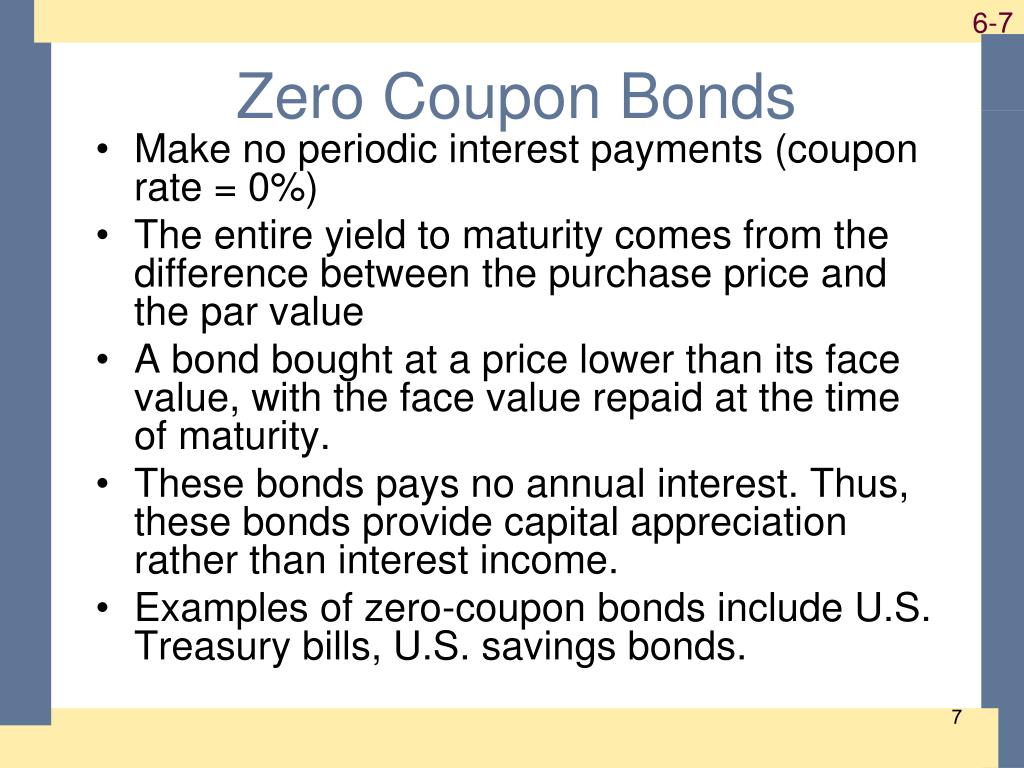

Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments. equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. Zero-Coupon Bond Value | Formula, Example, Analysis ... Zero-Coupon Bond Value Formula Price = \dfrac {M} { (1 + r)^ {n}} Price = (1+r)nM M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and ...

Present value of a zero coupon bond. How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... Bond Present Value Calculator See Present Value Concepts - Calculating the Present Value of a Bond and Present Value of a Bond Formula for discussions on computing the present value of bonds. Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Yield to Maturity Calculator Zero Coupon ... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

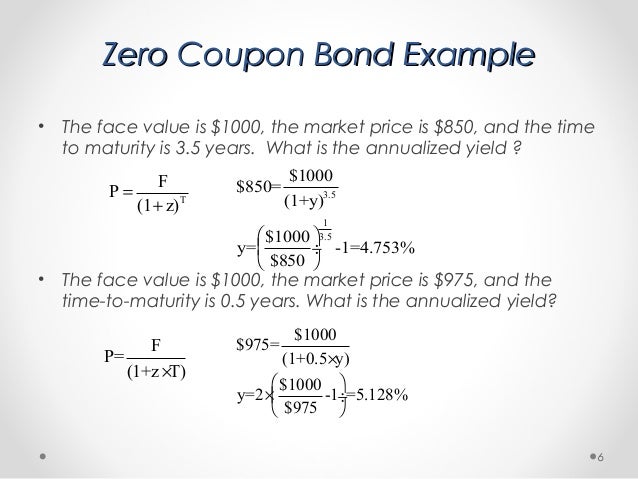

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. 38 yield of zero coupon bond So for example let's say that you bought a bond for $95,238.The face value of the bond was $100,000. So because it's a zero-coupon bond that we're talking about there's not going to be any periodic interest payments or anything like that it's just a simple 1-year bond where you pay $95,238 in a year from now and get $100,000 returned to you. Zero Coupon Bond Calculator - DQYDJ Zero Coupon Bond Calculator Outputs. Market Price ($): The market price of the bond, or its true value to fit the input criteria. What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the ... How to Calculate a Zero Coupon Bond Price | Double Entry ... n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

Present Value (PV) Definition 01-02-2022 · Present value states that an amount of money today is worth more than the same amount in the future. In other words, present value shows that money received in the future is not worth as much as ... Zero Coupon Bond Yield - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ... Zero Coupon Bonds - Financial Edge Training Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond Bond Pricing Formula - WallStreetMojo where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that …

Bond Definition: What Are Bonds? - Forbes Advisor Aug 24, 2021 · Using the $1,000 example, if a bond has a 3% coupon, the bond issuer promises to pay investors $30 per year until the bond’s maturity date (3% of $1,000 par value = $30 per annum). Yield: The ...

Zero-Coupon Bond: Formula and Excel Calculator In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond's cash flows equal to the current market price. To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV).

Zero Coupon Bond Value Calculator - buyupside.com Zero Coupon Bond Value Calculator. Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2.

Present Value Of Zero Coupon Bond Calculator Present Value Of Zero Coupon Bond Calculator - Present Value Of Zero Coupon Bond Calculator, Letter Box Coupons, Origami Owl O2 Coupon Code 2019, Yfcanvas Deals, Hobby Lobby 40 Off Coupon In Store, Hsn Coupon Codes Feb 2020, Apple Deals For College Students 2019

What is a Zero-Coupon Bond? Definition, Features, Advantages, Calculation, Example, Limitations ...

Coupon Bond Formula | How to Calculate the Price of Coupon ... = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

Net present value - Wikipedia The net present value (NPV) or net present worth (NPW) applies to a series of cash flows occurring at different times. The present value of a cash flow depends on the interval of time between now and the cash flow. It also depends on the discount rate. NPV accounts for the time value of money.It provides a method for evaluating and comparing capital projects or financial …

NPV Formula Excel - Calculate the Net Present Value The rate of return we could get in alternate investment is 10%. So, we need to find out the net present value of the business. The initial investment of the business is entered with a negative sign as it represents outgoing cash. Value 1 = -$100,000. The formula used for the calculation of the net present value of a business is: =NPV(B2,B3:B8)

Net Present Value Questions and Answers - Study.com Get help with your Net present value homework. ... A Treasury bond promises to pay a lump sum of $1,000 exactly 3 years ... has an expected useful life of …

Solved What is the present value of a zero-coupon bond ... What is the present value of a zero-coupon bond with a par value of R 1 000 000, which is due to be redeemed in 10 years' time, when the market interest rate for such a bond is 6% p.a. Interest is compounded semi-annually? a. R553 676 b. R744 094 c. R742 470 d. R861 667 Expert Answer Option a.)

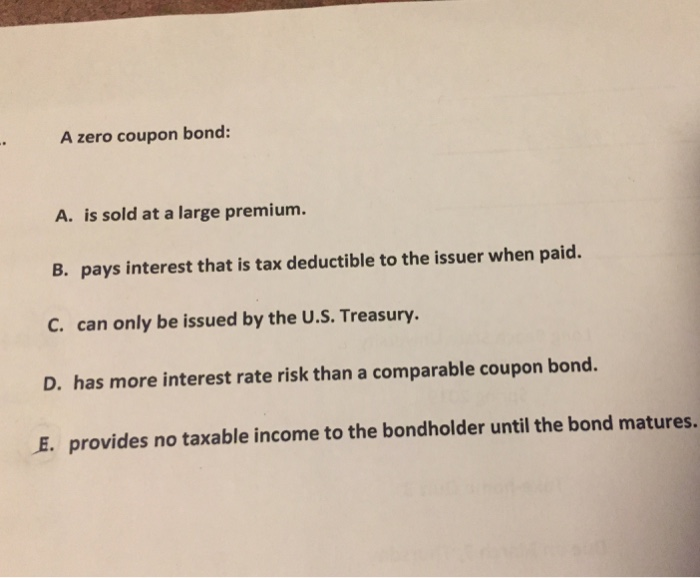

Chapter 6 Flashcards - Quizlet D. Zero-coupon bond Consol 8. A 10-year Treasury note as a face value of $1,000, price of $1,200, and a 7.5% coupon rate. Based on this information, we know the: A. present value is greater than its price. B. current yield is equal to 8.33%. C. coupon payment on this bond is equal to $75. D. coupon payment on this bond is equal to $90.

Zero Coupon Bond: Definition, Formula & Example - Video ... Present value = Principal / (1 + Rate)^ {Term} = 10,000 / (1.03^5) = $8,626.09 3. The answer is No . This is because the current market price is greater than the present value that you computed....

How Premium Bonds are Priced | Zero Coupon Bond | Savings Pricing a Zero Coupon Bond. A zero coupon bond does not make any interest payments throughout the life of the bond. There is only a single cash flow, at the time of maturity of the bond, when the par value of the bond is returned to the investors. Pricing such a bond is much simpler. Let's consider a zero coupon bond with a par value of ...

Value and Yield of a Zero-Coupon Bond | Formula & Example Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Zero Coupon Bond Calculator - MiniWebtool A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula

Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Zero Coupon Bond Questions and Answers - Study.com Calculate the present value of a $1,000 zero-coupon bond with 8 years to maturity if the required annual interest rate is 12%. View Answer. Consider two bonds. Each has a face value of $100 and ...

Post a Comment for "42 present value of a zero coupon bond"