39 coupon rate 10 year treasury

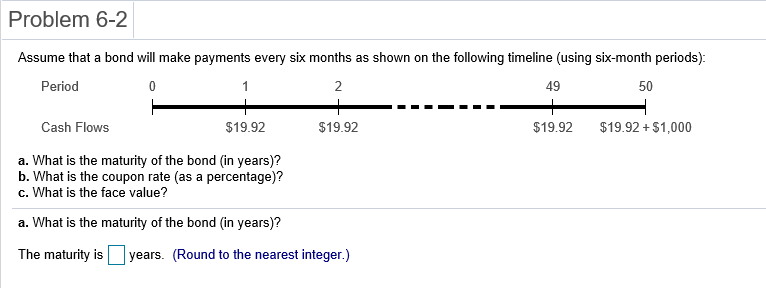

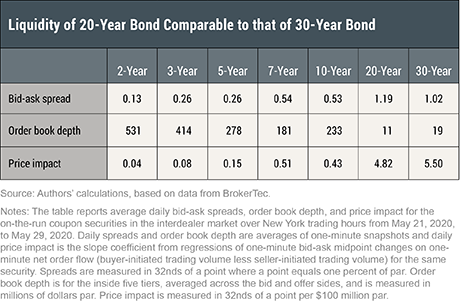

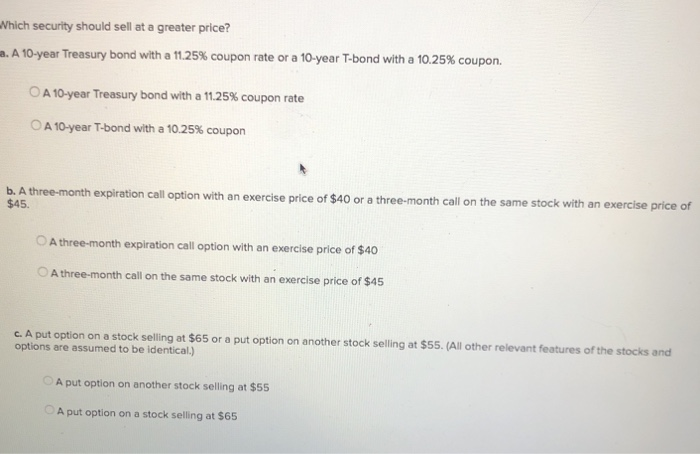

What is the Coupon Rate? - Realonomics The main difference between Coupon Rate and Required Return is that coupon rate is the constant value paid by the bond issuer at regular intervals until the. ... What is the coupon rate on a 10 year treasury? Treasury Yields. Name Coupon Yield; GT2:GOV 2 Year: 1.50: 1.93%: GT5:GOV 5 Year: 1.88: 2.15%: GT10:GOV 10 Year: 1.88: 2.16%: GT30:GOV 30 ... 10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market.

The 10-Year Treasury Yield Hits Highest Level Since 2011 Ahead of Fed The 10-year US Treasury yield surged to its highest level since 2011 on Monday, hitting a high of 3.51%. Monday's surge in Treasury yields came a day ahead of the Fed's upcoming rate hike decision.

Coupon rate 10 year treasury

10-Year Treasury Yield 'Fair Value' Estimate: September 20, 2022 Meanwhile, the benchmark 10-year US Treasury yield edged higher yesterday (Sep. 19), reaching 3.49% - matching the previous high set in June. For the moment, one can argue the market is on the ... Weekly Treasury Forecast, August 19, 2022: Negative 2-Year/10-Year … Aug 22, 2022 · The negative 2-year/10-year Treasury spread has persisted for 33 days, narrowing this week to a negative 27 basis points from negative 41 basis points last week. In this week's forecast, the focus ... 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of September 14, 2022 is 3.41%. Show Recessions.

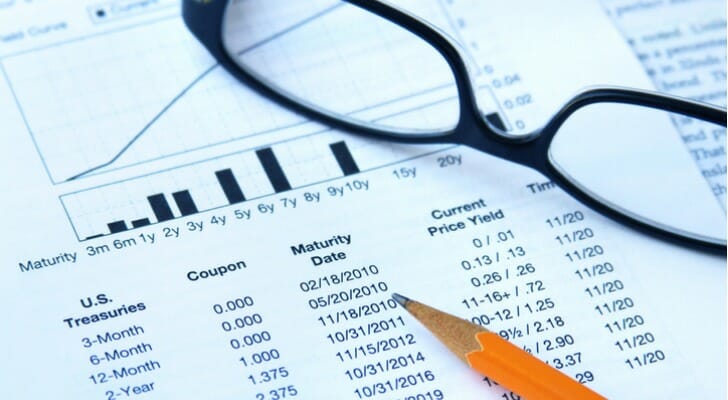

Coupon rate 10 year treasury. US Treasury Bonds - Fidelity US Treasury notes: $1,000: Coupon: 2-, 3-, 5-, 7-, and 10-year: Interest paid semi-annually, ... U.S. 10 Year Treasury Note Overview - MarketWatch Taiwan 10 Year Government Bond-0.1350: 1.4150%: Italy 10 Year Government Bond-0.0740: 4.0533%: Spain 10 Year Government Bond-0.0690: 2.9287%: Japan 10 Year Government Bond: 0.0510: 0.2515%: U.K ... US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.75% Maturity 2032-08-15 Latest On U.S. 10 Year Treasury INVESTING CLUB CNBC.com Content From Our Affiliates There is no recent news for this security. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What Is a 10-Year Treasury Note and How Does It Work? The basics of a 10-year T-note involve paying the government a single lump sum at the beginning to purchase the bond — $1,000 apiece. The government then pays interest twice a year until the bond matures, at which point the entire sum you borrowed will be returned. The interest rate, known as the "yield," expresses the annual return on ... Germany 10 Years Bond - Historical Data Current Yield: 1.880%. Last update: 21 Sep 2022 20:15 GMT+0. Germany 10 Years Bond Spread. The Germany 10 Years Government Bond ... US 10 year Treasury Bond, chart, prices - FT.com 16.9.2022 · US 10 year Treasury. Yield 3.46; Today's Change 0.008 / 0.24%; 1 Year change +152.17%; Data delayed at least 20 minutes, ... Wall Street stocks slide as investors look ahead to Fed rate rise Sep 15 2022; Investors on edge before … Solved The 10-year Treasury Note has a coupon rate of 2.4% | Chegg.com The 10-year Treasury Note has a coupon rate of 2.4% and is priced at 101.5% of par. A 10-year, BBB-rated corporate bond has a coupon of 4.3%. If the credit spread for BBB-rated bonds is 75 basis points, what is the price of the corporate bond? Assume coupons are paid semi- annually.

10-year coupon rate drops - Manila Bulletin The benchmark interest rate on debt falling due in 10-years declined at an auction of the government IOUs at the Bureau of the Treasury on Tuesday, Sept. 13. The coupon rate of the new 10-year Treasury bonds fetched at 6.75 percent, lower than the 7.75 percent when same instrument was sold in June 2022. 10-year Treasury yield rises to highest since 2011 | Reuters The 10-year yield, the most significant interest rate benchmark globally, rose as much as six basis points to 3.508%, the highest since April 2011. The Fed meets on Wednesday. Money markets are ... Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-09-09 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in ... 10 Year Treasury Rate - YCharts The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.49%, compared to 3.45% the previous market day and 1.37% last year. This is lower than the long term average of 4.26%.

10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once ...

Government - Continued Treasury Zero Coupon Spot Rates* 14.8.2013 · Prompt Payment Act Interest Rate. Monthly Interest Rate Certification. ... Continued Treasury Zero Coupon Spot Rates* Treasury Spot Rates, Office of Thrift Supervision (OTS) Method; ... *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy ...

TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ 19.9.2022 · TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today’s stock price from WSJ.

Interest Rate Statistics | U.S. Department of the Treasury At that time Treasury released 1 year of historical data. View the Daily Treasury Par Real Yield Curve Rates · Daily Treasury Bill Rates. These rates are ...

10-Year Treasury Yields Go Still Higher on Inflation Concerns The yield on the 10-year U.S. Treasury note is pushing higher amid concern about how aggressive the Federal Reserve will be in raising short-term interest rates this week.

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of September 15, 2022 is 3.48%. 30 Year Treasury - Historical Annual Yield Data;

10-Year T-Note Options Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ...

Treasury makes full award of new 10-year bonds on strong demand 13.9.2022 · THE GOVERNMENT fully awarded the fresh Treasury bonds (T-bonds) it offered on Tuesday on strong demand for higher-yielding instruments amid expecta tions of more rate hikes in the United States.. The Bureau of the Treasury (BTr) raised P35 billion as planned via the fresh 10-year T-bonds it auctioned off on Tuesday, with total tenders reaching P99.311 billion or …

A new 10-year TIPS will be auctioned Thursday. Anyone interested? One thing about Thursday's auction is certain: The Treasury will set the coupon rate for this TIPS at 0.125%, the lowest it will go for any TIPS. As of Friday's market close, the Treasury, on its Real Yields Curve page, was estimating that a full-term 10-year TIPS would have a real yield of -1.02%. That estimate has dropped 15 basis points since July 1.

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds are sold at the 7 year mark asking for the 10 year yield.

US 10-year T-Note Auction Coupon Rate | U.S. Treasury Bond US 10-year Treasury Note Futures Price (R) 2022-02-18. 126.67. MM US Treasury Note Fundamental Index (L) 2022-01-25.60. Source. CME; ... Save US 10-year T-Note Auction Coupon Rate. The coupon rate is viewed as the fundamental costs of buying bonds. When auction coupon rate is low, demand for bonds could be huge, which leads to an increase in ...

Ultra 10-Year U.S. Treasury Note Options Quotes - CME Group Ultra 10-Year Note Yield Curve Analytics ... a robust measure of 30-day implied volatility derived from deeply liquid options on Treasury futures. CME FedWatch. Explore probabilities for FOMC rate moves, compare target ranges or view historical rate data. Treasury Analytics. Analyze deliverable baskets, CTD/OTR securities, futures/cash yield ...

10-Year High Quality Market (HQM) Corporate Bond Spot Rate Sep 10, 2022 · Graph and download economic data for 10-Year High Quality Market (HQM) Corporate Bond Spot Rate (HQMCB10YR) from Jan 1984 to Aug 2022 about 10-year, bonds, corporate, interest rate, interest, rate, and USA.

Individual - Treasury Notes: Rates & Terms Interest Coupon Rate Price Explanation; Discount (price below par) 10-year Note Issue Date: ...

10-year Treasury yield climbs to fresh 11-year high as Fed decision ... The yield on the 2-year Treasury note briefly surpassed 4%, while the 10-year rate hit a fresh 11-year high on Tuesday as investors prepared for the Federal Reserve's next aggressive rate increase.

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... Categories > Money, Banking, & Finance > Interest Rates > Treasury Constant Maturity. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an ... Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10 ...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by ...

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search the ... US 10 year Treasury. Yield 3.60; Today's Change 0.108 / 3.08%; 1 Year change +174.75%; Data delayed at least 20 minutes, as of Sep 20 2022 15:45 BST. ...

10-Year Treasury Note and How It Works - The Balance 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond 12 Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments.

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of September 14, 2022 is 3.41%. Show Recessions.

Weekly Treasury Forecast, August 19, 2022: Negative 2-Year/10-Year … Aug 22, 2022 · The negative 2-year/10-year Treasury spread has persisted for 33 days, narrowing this week to a negative 27 basis points from negative 41 basis points last week. In this week's forecast, the focus ...

10-Year Treasury Yield 'Fair Value' Estimate: September 20, 2022 Meanwhile, the benchmark 10-year US Treasury yield edged higher yesterday (Sep. 19), reaching 3.49% - matching the previous high set in June. For the moment, one can argue the market is on the ...

/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

Post a Comment for "39 coupon rate 10 year treasury"